Want to know how much seller closing costs are in California?

This guide breaks it down.

I’ll walk you through the common seller closing costs in California and what each fee covers.

You’ll also see examples so that you can estimate your numbers.

Then I’ll show you what these costs look like on a closing statement, so you know exactly what gets deducted at closing.

Typical closing costs for sellers in California

Typical closing costs for a California home seller usually run around 0.5% to 2.5% of the sale price, not including real estate agent commissions.

That percentage depends on your final sale price, the terms in your purchase agreement, and the county and city where you’re selling.

Sellers usually don’t pay anything out of pocket.

In most cases, the escrow company pays these costs out of your proceeds at closing.

You’ll see every fee itemized on your closing statement.

Here’s a line-item breakdown of the typical closing costs a seller pays in California.

Real estate commission

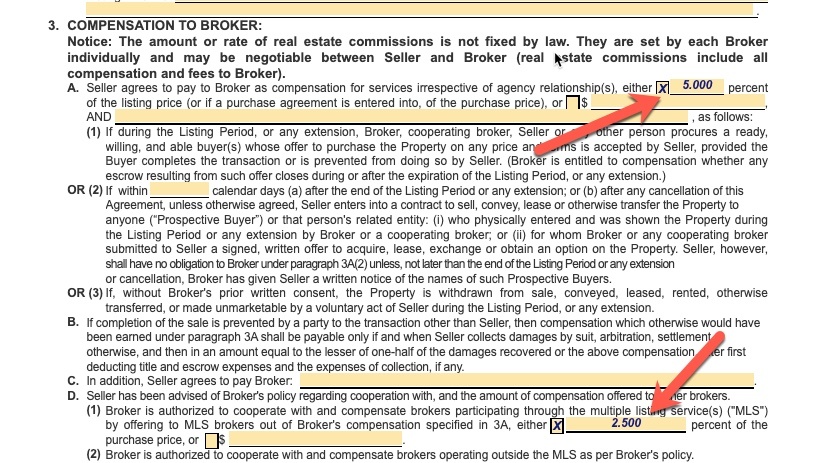

Real estate commission is usually the biggest cost of selling a home in California.

In most transactions, the seller pays a total commission that covers the listing agent and the buyer’s agent (the buyer’s offer typically requests it).

In California, many sellers pay around 5% to 6% of the final sale price. The exact amount depends on your market, your price point, and what you negotiate.

You’ll confirm the percentage in the listing agreement, which also shows how the commission is split between the brokerages.

Here’s what that looks like:

Escrow fees

Escrow fees are one of the standard closing costs in a California home sale.

They cover the escrow company’s work to coordinate the closing, collect and distribute funds, and make sure the paperwork gets signed and recorded correctly.

The amount is usually based on the sale price.

A rough rule of thumb is about $2 per $1,000 of the sale price, plus around $250 (fees vary by company and county).

Example: If your home sells for $1,000,000, escrow fees often land around $2,250.

Who pays escrow fees depends on your area and what you negotiate.

Some counties typically have the buyer pay, others split it, and some place it on the seller.

Here are a few examples of who typically pays for escrow fees in California:

Alameda County: Buyer

Contra Costa: Buyer

El Dorado: Split 50/50

Fresno: Split 50/50

Los Angeles: Split 50/50

Orange: Split 50/50

Riverside: Split 50/50

San Francisco: Buyer

San Mateo: Seller

Santa Clara: Seller

Santa Cruz: Split 50/50

Ventura: Split 50/50

Title insurance

Title insurance protects against title problems, like unknown liens, recording errors, or ownership claims that show up after closing.

In many California sales, two separate title insurance policies come into play:

Lender’s title policy (protects the buyer’s mortgage lender). The buyer usually pays this when they finance the purchase.

Owner’s title policy (protects the buyer). Who pays often depends on what’s standard in your county and what you negotiate with the buyer.

The cost for title insurance in California varies by sale price and title company.

But many sellers can ballpark the cost at about 0.225% of the sale price.

Example: On a $1,100,000 sale, that’s roughly $2,475.

For a more accurate estimate, ask your escrow or title company for a quote (or use a title insurance calculator).

Transfer taxes (documentary transfer tax)

When a property changes hands in California, the county (and sometimes the city) charges a transfer tax.

You’ll usually see this listed as a documentary transfer tax on the closing statement from escrow.

In some areas, the seller pays pays this cost.

In others, the buyer and seller split the tax 50/50.

And sometimes the seller pays the county tax and the buyer pays the city tax (or vice versa).

It all comes down to what’s typical in your county and what you negotiate.

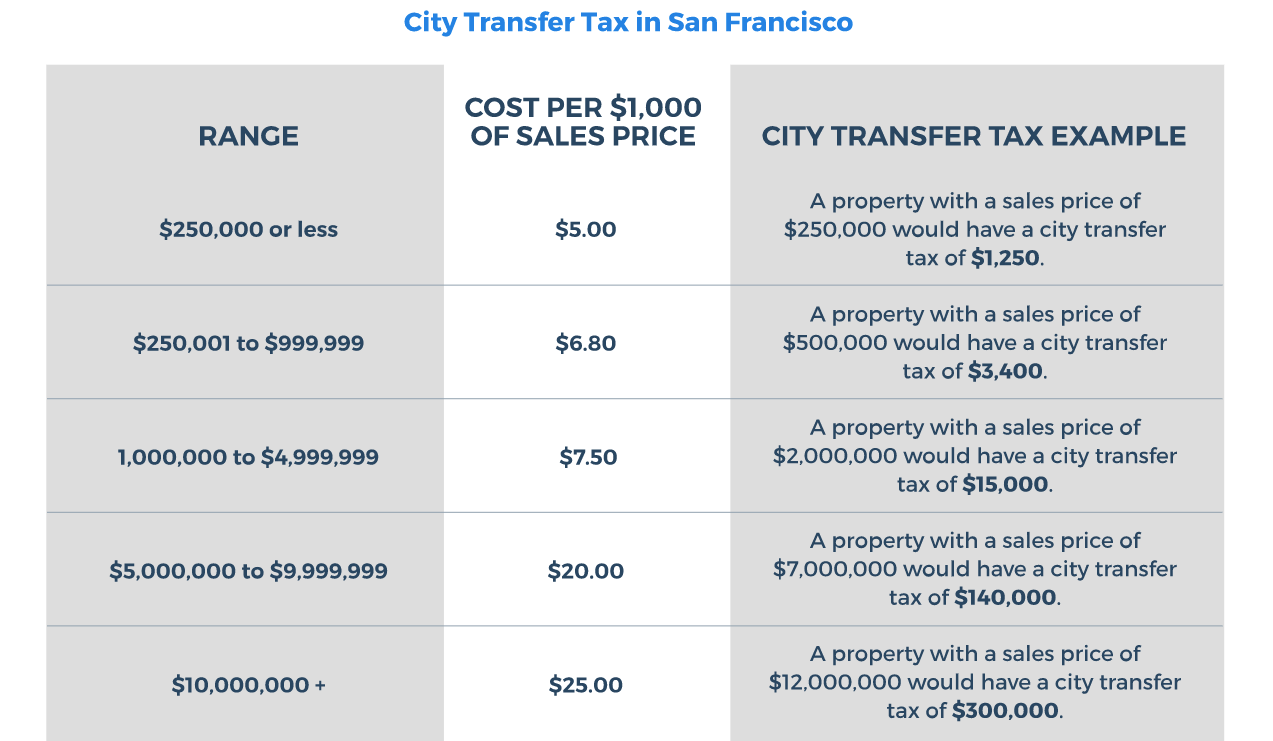

County transfer tax

Most California counties charge $1.10 per $1,000 of the sale price (about $1,100 on a $1,000,000 sale).

San Francisco County is the exception to that.

They use their own tiered rates, so the total can be higher.

City transfer tax

Some cities also charge a city transfer tax, but not all do.

For example, in Santa Clara County, San Jose, Palo Alto, and Mountain View charge $3.30 per $1,000 (about $3,300 on a $1,000,000 sale).

City rates vary, so you’ll want to check your specific city.

Miscellaneous Fees

In addition to the big-ticket items, your closing statement will include a handful of smaller fees.

These vary by transaction, but common examples include:

- Recording fee

- Notary fee

- HOA fee (if the property has an HOA)

- Any reports and/or inspections (including home inspection fees) that are not paid upfront.

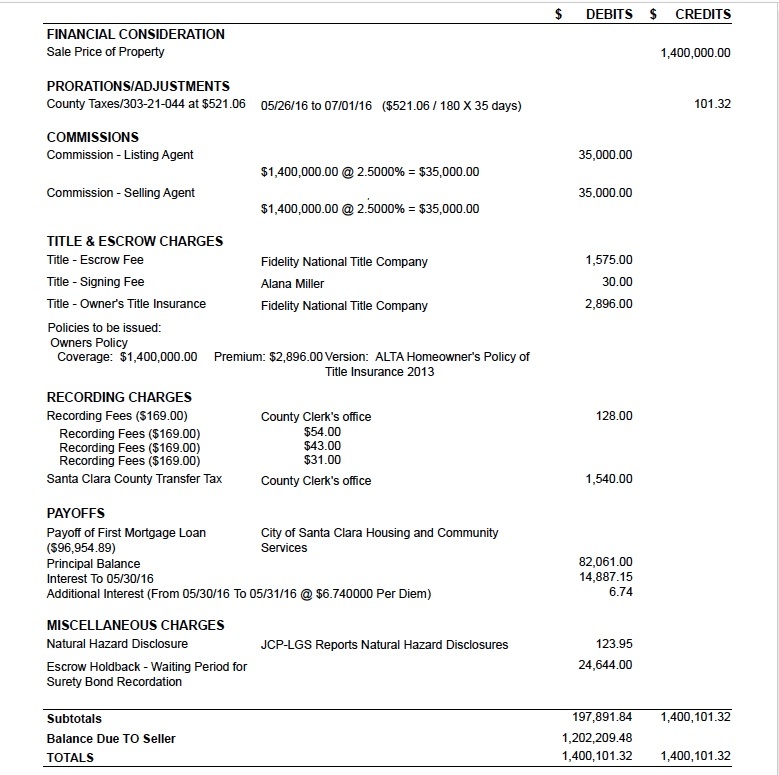

What California seller closing costs look like on a closing statement

The escrow company provides sellers with a closing statement (also called a settlement statement).

It shows your final sale price, every closing cost line item, and your net proceeds.

You’ll typically see agent commissions, escrow fees, title-related charges, transfer taxes, and smaller fees like recording and notary.

The statement also includes prorations (like property taxes and HOA dues) and your mortgage payoff, because they change your proceeds.

Here’s an example of a closing statement for a California seller showing how these fees (and the rest of the closing costs) get itemized:

You don’t have to wait until closing day to see these numbers.

Your listing agent can ask escrow for a net sheet early on based on your expected sale price and estimated mortgage balance.

Escrow can also update the estimate during the transaction before issuing the final closing statement after the sale closes.

Conclusion

California seller closing costs add up fast, especially once you include commission, transfer taxes, and escrow and title fees.

For a quick estimate, use the typical percentage range for each cost (you can also use our home selling calculator to get a ballpark number).

Want the most accurate estimate?

Ask your listing agent to request a net sheet from the escrow company.

That will show your estimated costs and net proceeds before you accept an offer.

The right agent can spot surprises early and help you net the most from your sale.

But to get that outcome, you need to know what to look for when choosing a listing agent.