A real estate agent’s commission is one of the least understood aspects of buying or selling a home.

It’s also one of the most expensive.

So it’s no surprise that some buyers and sellers question paying an agent’s commission.

And with changes to how agent compensation works, that question makes even more sense.

But what you don’t know about real estate commissions could cost you.

Because a good agent can be invaluable.

That’s why it’s crucial to understand how Realtor fees work — and what you’re really paying for.

Here’s everything you need to know about real estate agent commission.

How much does a real estate agent cost?

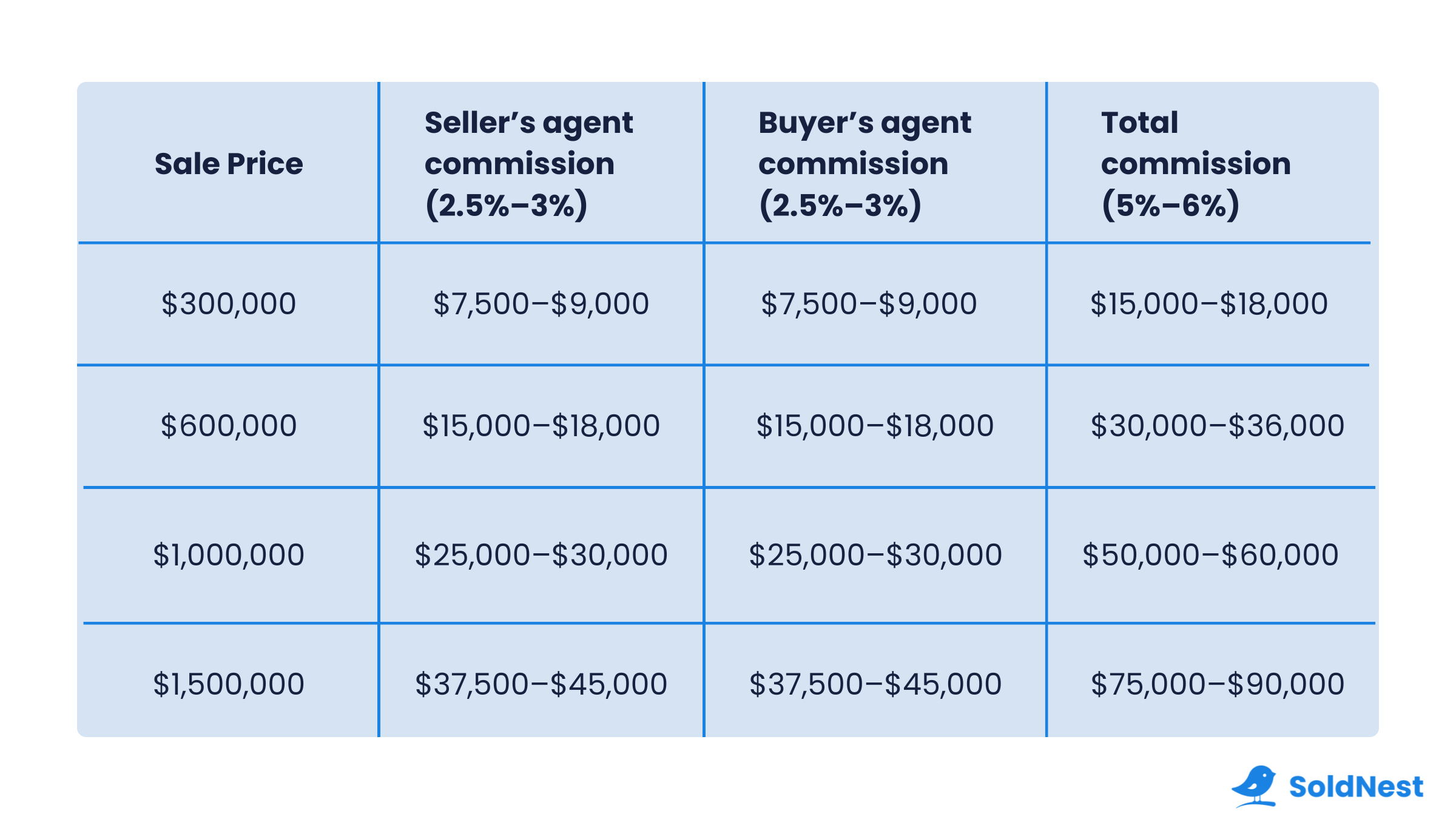

A listing agent and a buyer’s agent typically each charge a commission of 2.5% to 3% of the home’s final sale price.

That means the total average commission in a U.S. real estate transaction usually ranges from 5% to 6% of the sale price.

Here’s how real estate agent fees break down at different price points:

As the table shows, Realtor commissions can add up quickly.

Most agents use a percentage-based model, which makes these fees one of the biggest costs in a real estate transaction.

A smaller number of agents charge a flat fee or offer a discount to compete on cost.

But these models are less common.

How much commission does the agent actually make?

While an agent’s commission might be 2.5% to 3%, they don’t pocket the full amount.

Most agents split their commission with their brokerage.

For example, on a home that sells for $600,000 with a 2.5% fee, the total payout is $15,000.

That check goes to the brokerage, which then pays the agent their share.

An experienced Realtor might keep up to 90% of the commission.

Newer agents or those with lower sales volume typically keep 50% to 80%.

So on that $15,000 commission, the agent’s gross earnings would range from $7,500 to $13,500.

It’s also worth noting that real estate agents only get paid when a sale closes.

That means they take on real risk — investing time, marketing costs, and effort without a guaranteed paycheck.

What affects how much commission you’ll pay a Realtor?

The commission paid to a Realtor isn’t always a fixed percentage.

Agents set their own rates.

And real estate commissions are negotiable.

Here’s what can impact how much a Realtor charges:

Home value: Higher-priced homes often come with lower commission rates, while lower-priced homes may have higher rates. For example, a 2.5% commission is more common in mid-to high-priced markets, whereas 3% to 3.5% is more typical in lower-priced areas.

Location or region: Where the property is located can significantly influence commission rates. In competitive metro areas, agents may charge slightly lower fees to win business. In rural or slower markets, higher rates are more common to offset the fact that the agents in those markets have fewer transactions.

Market conditions: In a hot seller’s market, some listing agents may reduce their rates to stay competitive. Buyer’s agents, on the other hand, may be less flexible, especially if they’re working harder to secure deals for clients.

Agent experience: Seasoned agents with strong track records may charge more based on their expertise, negotiation skills, and results. In many cases, the right agent can earn you more than they cost.

Services offered: Agents who provide full-service support typically charge a standard sales commission (or higher). This includes pricing expertise, market insight, strategic guidance, personalized support throughout the process, and more.

Brokerage rules: Some brokerages enforce commission minimums or set pricing structures, which may limit an agent’s ability to negotiate their rate — even if they’d like to.

Dual agency: Agents are often more open to negotiating their fee when representing both the seller and the buyer in the same sale. But this setup creates a conflict of interest. They can’t guide either side on pricing, counteroffers, or strategy. And it blurs their fiduciary duty — the legal obligation to put your interests first. Most people don’t realize what a dual agency deal really costs them.

Changes to real estate commission

The current real estate agent commission model stems from a major lawsuit settled against the National Association of Realtors (NAR) in August 2024.

As part of the settlement, new rules were introduced to give both buyers and sellers more transparency and leverage when negotiating agent fees.

These changes have reshaped how commissions are disclosed and agreed upon.

But they haven’t significantly changed how much most agents charge.

Here’s an explanation of the three major changes to real estate commission.

The listing agreement now only includes the seller’s agent’s commission

Before the 2024 settlement, the listing agreement a seller signed with their agent included the total commission amount.

That fee was usually 5% to 6% of the home’s sale price, similar to what the total commission is today.

It also broke down how that commission was divided:

- The portion going to the listing agent’s brokerage

- The portion being offered to the buyer’s agent’s brokerage

Today, the listing agreement only includes the commission the seller agrees to pay their own agent’s brokerage.

Any commission offered to the buyer’s agent is now handled outside of the listing contract.

Buyers must now sign a buyer representation agreement

Many buyers used to work with a real estate agent without signing a formal agreement.

It wasn’t uncommon to tour homes, ask for advice, and even submit offers — all without anything in writing.

That’s no longer allowed.

Under the new rules, buyers must sign a buyer representation agreement before an agent can help them prepare an offer.

The agreement spells out the scope of services, the terms of the relationship, and the agent’s commission.

This change adds a level of transparency and accountability that didn’t exist before.

And it ensures the buyer is formally partnering with their agent.

Buyer agent commission is no longer displayed in the MLS

When a real estate agent lists a home, they upload the property details to the MLS (a database used to share listings with other agents).

Up until the 2024 lawsuit, the commission being offered to a buyer’s agent was included.

But the new rules changed that.

Listing agents are no longer permitted to advertise buyer agent compensation in the MLS.

Why the change?

Because some agents were dissuading buyers from making an offer on a home where the commission offered was lower than “normal.”

These agents were instead steering clients toward homes offering a higher commission.

Removing commission details from the MLS helps reduce that bias and brings more transparency to the homebuying process.

What you get for paying commission to a real estate agent

The commission you pay isn’t just for putting your home on the MLS or unlocking a door to tour a property.

It covers a range of services, strategies, and responsibilities that can directly impact your sale price.

Here’s what you get for paying a commission to a Realtor.

Sellers

Pricing strategy: Agents use a comparative market analysis (CMA) to help determine your asking price. They compare similar homes, make value adjustments, and recommend a price that fits your current market.

Home preparation advice: Commission covers guidance on repairs, staging, and updates. Agents also connect you with service providers and help prioritize what’s worth doing before your house hits the market.

Marketing: Your listing will be added to the MLS and promoted through photography, marketing materials, online listings, and open houses — all coordinated by your agent.

Offer management: Agents handle offer reviews, help structure counteroffers, and negotiate terms. A listing agent’s role is to represent your interests and guide you through every step of the sale.

Transaction coordination: Agents manage documents, disclosures, deadlines, and third-party communications — ensuring all paperwork and legal steps are handled through closing.

Buyers

Local market insights: A buyer’s agent will help you understand property values, neighborhood trends, and what’s realistic for your budget. They’ll also provide guidance on how local inventory and competition affect your search.

Home tour coordination: Your agent takes care of scheduling showings and accompanying you to see homes in person. They’ll also help spot any red flags you might miss and help assess how each home fits your needs.

Offer preparation and submission: Real estate agents handle the paperwork and strategy involved in making an offer. That includes researching comparables, explaining contingencies, and structuring terms to keep your offer competitive.

Transaction support: Between offer acceptance and closing, your agent will coordinate key steps like inspections, appraisals, repair requests, and contingency removals — helping you stay on track with deadlines.

Closing coordination: Agents work with your lender, escrow company, and title company to help finalize the sale. They’ll ensure all documents are submitted and everything is ready for closing day.

Ways to save on real estate agent fees

Working with a traditional full-service agent is the most common approach for both buyers and sellers.

But it’s not the only one.

There are alternative options that can reduce (or even eliminate) the fees typically paid to Realtors.

Here are five ways to save on commission:

Discount agents: Some brokerages advertise reduced listing fees, often with limited services. These low-commission agents handle the basics but typically do not provide the full strategic support of a traditional agent. Buyers can also find discount models, especially with brokerages that offer flat fees or minimal representation in exchange for lower costs.

Selling on your own (FSBO): For sale by owner means you skip the listing agent and avoid paying their commission. But it also means you take on pricing, marketing, negotiations, paperwork, and legal risk. You’ll still need to offer a buyer’s agent commission in most cases, but the potential savings can be worth it if you’re experienced and prepared.

Flat-fee MLS listings: With a flat-fee MLS service, you pay a set amount to have your property listed in the MLS without full agent representation. It’s a way to get exposure while managing the sale yourself — but you’ll need to handle pricing, marketing, and negotiating on your own.

À la carte or limited services: Some agents offer à la carte services where you only pay for what you need — such as pricing guidance or reviewing the purchase contract. This is an option for both buyers and sellers who want professional input without paying for the full package.

Cash buyers: Selling your home to a cash buyer means you can skip commissions entirely. These sales usually close quickly with less hassle, but the offer price is often well below market value. It’s a good option if you prioritize speed and convenience over profit.

Are real estate commissions worth it?

There’s no denying that agent fees are one of the biggest costs in a real estate transaction.

That’s why some buyers question their agent’s commission.

But the real question isn’t what you’re paying.

It’s what you’re getting in return.

A good agent can be worth far more than their fee.

They can help you avoid issues that you’re not aware of.

Things like pricing your home wrong, mistakes on your disclosures, weak negotiating, and messing up the purchase contract.

Skip that support, and you risk leaving money on the table and running into avoidable issues.