Are you gearing up for or already involved in a real estate transaction?

Then this article will be incredibly important for you to read, especially if you’re selling.

That’s because most people assume that homebuyers and sellers should each have their own dedicated real estate agent.

But some home sales spark dual agency.

These scenarios allow the listing agent to also work as the buyer’s agent.

Essentially, the seller and buyer share the same real estate agent in a dual agency.

Sounds like a disaster waiting to happen?

In most cases, it is.

Many real estate agents won’t tell you why (especially the ones who have a history of acting as a dual agent).

But I will.

I’ve seen and have been involved in dual agency transactions that have cost buyers and sellers tens of thousands of dollars (at a minimum).

These non-exclusive representations are one of the best hidden secrets in the real estate industry.

And one of the primary reasons why SoldNest was founded.

I sincerely hope you read this entire article — even if you don’t plan on working with a dual agent — because you’ll learn about how dual agency could affect the outcome of your home sale in unexpected ways.

Here’s everything you need to know about dual agency — and why you should probably avoid it.

What is dual agency in real estate?

From a legal standpoint, the definition of dual agency is when one real estate agent represents both the buyer and seller in the same transaction — or when the buyer’s and seller’s agents are from the same real estate company (with the same office address).

It applies to both scenarios because buyers and sellers technically form a relationship with the real estate brokerage who their agent is licensed with, and the agent is a representative of the brokerage.

A dual agency arrangement is only supposed to be permissible if all parties involved are informed and consent to the dual agent’s role.

Sellers consent by signing a standard disclosure form that comes attached to the listing agreement.

In other words, a seller “agrees” to dual agency before their property is even listed –– although many are never told what it is and what they’re actually signing.

And the buyer will usually sign this same document when they sign an agreement with their agent (buyer broker agreement) –– or when they put their offer in writing via a purchase contract.

In most states, this form is called “Disclosure Regarding Real Estate Agency Relationship.”

It outlines a real estate agent’s duties and responsibilities, including the fiduciary duties they’re supposed to uphold when acting as a dual agent.

A dual agency transaction is officially in the works after the purchase contract is ratified and the buyer and seller acknowledge their consent in writing.

Who pays commission in dual agency?

The seller typically pays the real estate commission in a dual agency situation.

This is similar to a traditional home sale where the buyer and the seller each have their own representation.

The total commission rate typically ranges from 5% to 6% of the final sale price.

But the critical difference in commission for a dual agent sale is who receives the payment.

In non-dual agency deals, the commission is usually split 50/50 between the brokerages of the buyer’s and seller’s agents, with agents receiving a portion.

However, that’s not the case when there’s integrated representation.

Dual agency commission is only paid to the agency the listing agent works for.

Which means a dual agent double-ends the commission when representing both sides.

Why is dual agency problematic?

The opportunity for a dual agent to earn double commission is the reason why dual agency is troublesome.

It’s an open invitation for a real estate agent to put the seller’s and buyer’s best interests below their own.

Think about it…

Can a dual agent honestly serve the needs of two sides that have separate goals?

They can certainly referee the transaction — but it’s going to be near impossible to give advice and act with 100% integrity.

In rare situations, it can make sense for a real estate agent to represent both the buyer and seller in the same sale (which we’ll discuss shortly).

But it’s almost always best to avoid a dual representation scenario.

Why dual agency is bad for sellers

The outcome is rarely favorable for a seller when their listing agent takes on a dual role.

Why?

Because it can easily be the reason why the final sales price is much lower than it should be — without the seller ever knowing.

Here’s one example of how dual agency can be detrimental for a seller…

Before SoldNest, I had buyer clients who fell in love with a home after looking for several months.

So we put a great offer together that included:

- An offer price of $1,840,000 (listed at $1,799,000)

- No contingencies and a 25-day close

- Their pre-approval letter from Wells Fargo (with a 30% down payment).

It took one day and a follow-up by email, text, and a phone call to get confirmation from the agent that he received our offer (not normal).

He emailed the day after and said, “Thank you, but the sellers have decided to accept another offer.”

I already knew what happened.

No response and zero negotiating effort from the real estate agent representing the seller typically means they’re also representing the buyer (or an agent they know is).

My suspicion was confirmed when the house sold a month later.

The final sale price?

$1,810,000.

That’s $30,000 less than what my clients offered (and they would have gone a bit higher, too).

Shortly after, through undisclosed means, I discovered that the seller was unaware of my client’s offer.

This isn’t unusual for a dual agency scenario.

Dual agents are very good at utilizing certain tactics so they can make more money by also representing the buyer.

These undisclosed situations occur daily, and I have many more examples I can share.

The dual agent pockets more money — but the seller walks away with less.

The unacceptable risk of a lower selling price is why a home seller should almost always avoid working with a dual agent.

And this is why being swindled by a dual agent ranks on our list of shady tactics to watch out for with real estate agents.

Why dual agency is bad for buyers

Many buyers assume working with a dual agent will get them a “better deal.”

In some cases, it can.

But dual agency can be bad for a buyer because they’re working with a real estate agent who is representing the party with opposing interests.

And that dual agent is financially motivated.

It’s usually too late by the time a buyer realizes the repercussions.

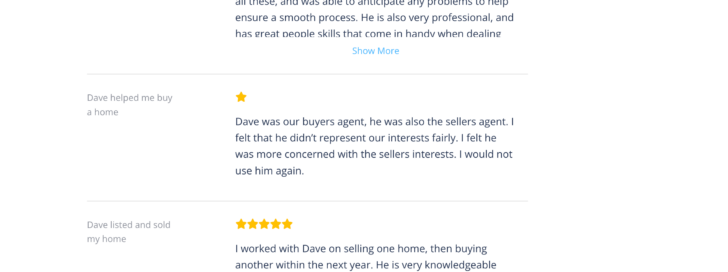

This review left on a competitor’s website is a good example:

Buyers like this often discover issues with the property that should have been disclosed prior to the sale.

But they didn’t find out beforehand because they didn’t have their own agent to fight for them.

These undisclosed issues can have a negative impact on the home’s value.

That might include situations like:

- Bad neighbors

- Neighborhood noise

- Crime

- A death on the property.

And problems with a home inspection are not uncommon for a buyer when they work with a dual agent.

Some dual agents will discourage buyers from conducting their own due diligence — or avoid pressing the seller to cover repairs found on an inspection report.

Dual agency can make buyers believe they’re getting a better deal.

But the significant risk of paying more than the perceived “deal” highlights why buyers should almost always have single agent representation.

Dual agent scenarios to watch out for

It’s critical to remember that the higher commission is the reason why a real estate agent is the one who benefits most from a dual agency sale.

Because the incentive can influence how a dual agent scenario presents itself to you — and the intent behind it.

In other words…

You need to be aware of key tactics to effectively handle a real estate agent representing both the buyer and seller.

And you should be prepared to fire your agent if they push for dual representation.

Red flags for sellers

Here are the two most common situations where a dual agent sale can present itself to a homeowner.

An offer from your listing agent’s buyer

This situation is specifically referencing when your property is listed on the market.

Your agent will notify you when they’ve received an offer and will follow up by discussing the price, terms, contingencies, etc.

If they tell you they’re also representing the buyer, then be sure to ask these two questions:

- Is this the only offer you’ve received?

- What are your thoughts about counter offering on price?

The first question will help you hold your agent accountable.

The answer to the second question will clue you in to their intent.

An immediate reply with something such as, “I don’t think there’s any room” or “I don’t think that’s a good idea” is a clear indication of the agent’s motivation.

And it’s probably a signal that there’s an opportunity for the buyer to come up in price.

Selling off market to a buyer

One of the biggest fears home sellers have is not being able to sell their home in a desirable time frame.

Real estate agents know this.

And some use it to their advantage to double-end a home sale.

Here’s how…

“I have a buyer who is looking for a home like yours.”

Sometimes this is a blatant lie an agent will use to get their foot in the door so they can list the property.

But sometimes it’s true.

The agent will have a typical buyer client who is actively looking for this type of home.

In this situation, it’s common for an agent to preach about the benefits of “selling off-market.”

But not putting a home on the market is the gateway to a lower selling price.

So if this situation presents itself, then be sure to ask:

- What is the average time to sell a home like mine over the last ~90 days?

- How much can we get if we put the house on the market?

Get the answers in writing.

Any agent can get the average days to sell from their local MLS.

And they can also provide you with a comparative market analysis to give you an estimated selling price.

But the opportunity to earn a dual agent’s commission might tempt them to suggest an overly conservative price.

So solidify their intent by requesting an analysis from another real estate agent (two would be better).

Red flags for buyers

Here are two situations in which home buyers may encounter a double-sided real estate transaction.

Approached by the listing agent

Many buyers inquire about a property with the seller’s agent (or an agent on their team).

This most often happens at an open house.

The buyer will usually ask questions such as, “Why are the sellers selling?” and “What are the seller’s expectations?”

Some conversations are brief.

But others continue because the buyer shows real interest by asking questions that their own agent should inquire about.

Most listing agents can spot this from a mile away.

This is usually when they’ll ask the buyer if they’re working with another real estate professional.

If you encounter this situation and answer with “No” — then there’s a good chance that you’re going to be pitched a dual representation scenario.

This is when you’ll want to clarify the agent’s intent.

You can do this by asking them, “How can I benefit if I share the same agent with the seller?”

Pay very close attention to the answer.

The red flag to watch out for is if they respond with anything other than “You can’t.”

Because anything other than the truth suggests a high likelihood of dishonesty on crucial matters if you choose to engage in a dual agency situation.

Presented with an off-market deal

Sometimes an agent working with a buyer will have a listing coming soon that fits what their clients are looking for.

Many buyers perceive this as a great opportunity (especially in a low-inventory market).

And in some cases, it can be.

But ask yourself this…

Why does the agent want to sell the house off-market?

The typical answer that agents will respond with is, “The seller doesn’t want to go through the hassle of showings.”

Showings and open houses can indeed be inconvenient for sellers — but this pales in comparison to the potential loss from not listing their house on the market.

So you should consider it a red flag if your buyer’s agent tells you they have an off-market opportunity.

And you should clarify their intentions.

You can do this in the same way you would if you approached a listing agent at an open house.

Ask them, “How can I benefit if you’re representing both the seller and me?”

Anything other than “you don’t benefit” is a red flag.

Because this indicates you’re working with an agent who is prioritizing their interests above yours.

When does it make sense to work with a dual agent?

Sometimes having a real estate agent who represents both the seller and the buyer can work.

Let’s take a look at three specific scenarios that could make sense for both parties to share the same agent.

When the seller and buyer know each other

Working with a dual agent can be a good idea if the buyer and the seller already have an existing relationship.

Dealing with a family member or close friends?

A dual agent can help streamline these sorts of transactions.

That’s because the parties involved are likely to come to an agreement more easily — whether on price or terms.

In other words, there’s a good possibility that the real estate agent won’t need to negotiate.

When the listing agent is willing to reduce their commission

In most transactions, two different real estate agents split a total commission of around 5-6% of the final sales price.

Some agents might be willing to reduce this total in a dual-agency scenario.

Something like 6% to 5% or 5% to 4%.

The problem with this is that they’d still be making more money than they would if there were two separate agents.

And that increases the chances of the agent not acting in the best interests of either party.

But there is a scenario where a dual agency arrangement can make sense for both the buyer and the seller.

When the agent is willing to forfeit a higher commission.

Eliminating the amount that would have been paid to the buyer’s agent reduces the chances of the shared agent risking their integrity.

When both parties are fully aware of dual agency drawbacks

Some real estate agents don’t explain the disadvantages of dual agency in real estate.

Why?

Because they’re afraid that the buyer or seller won’t want them to represent the other party.

In other words, they don’t want to risk losing the double-ended commission.

But it’s a good sign when an agent fully discloses what happens in a dual agency transaction.

It shows that they’re being up front and honest.

So working with a dual agent could make sense if the buyer and the seller are:

- Fully aware that the agent can’t negotiate on their behalf to the best of their ability

- Informed that the agent also has a fiduciary duty to the other party

- Conscious about the agent’s commission

- Comfortable with the price and terms.

Benefits of choosing an agent with low dual agency sales

A real estate agent’s percentage of dual agency transactions to listings sold is the most important quality you should consider when choosing an agent.

Why?

Because it’s a key data point that reflects an agent’s character.

Real estate agents who avoid acting as a dual agent are much more likely to prioritize your best interests.

That’s not the case if you work with an agent who has a history of representing both parties.

These are the agents who are more likely to guide you in the wrong direction.

One example is intentionally being misled on price.

Agents who prioritize their commission are more likely to convince a buyer to offer a higher price so that they can move on to their next client.

Or they may persuade a homeowner to list their home at an unrealistic price to secure their business.

There’s a direct correlation between the agents who have a higher-than-average ratio of dual agency sales and the agents whose listings stay on the market longer (and have an inflated number of price reductions).

How do I know?

Because analyzing an agent’s percentage of dual agency transactions is part of our agent vetting process when matching sellers with listing agents.

Experience, reviews, expertise, and not being locked into a contract are all critical things you need in an agent.

But the often overlooked yet most revealing factor in finding a good agent — especially for sellers — is their history of dual agency transactions.

The bottom line

Dual agents represent the buyer and the seller in the same real estate transaction.

But clients can suffer when they share the same agent — especially sellers.

The easiest way to avoid this?

Work with an agent who has a track record of prioritizing their client’s best interests.

This means hiring a real estate agent with a low history of dual agency.

It can be difficult to know who these agents are.

That’s where our agent vetting process (no-cost service) can do the homework for you.

We analyze home sales (including dual agency) and online reviews to match home sellers with a top local agent who has a proven track record of putting their clients first.

Remember — even if you instruct your agent to not represent the other party — an agent’s ratio of dual agency transactions is a key indicator of their character.